Homeowners may choose to file an insurance claim to help cover the costs of costly roof repairs or a roof replacement after a damaging hailstorm or windstorm. Homeowners may experience much stress with the uncertainty of the insurance claims process and possible damages to their homes.

Finding a reputable roofing company that provides professional roof inspections and has experience with hail damage insurance claims experience can alleviate much of the stress. Homeowners typically trust the roofer’s recommendation to file a claim. Some roofing companies detail their inspection results with photos and video to show homeowners any damages found, which can assure the homeowner of actual roof damage.

With a filed claim, most homeowners expect that their insurance company will find similar damages and cover the roof repair or replacement costs. Unfortunately, insurance companies make grandiose promises with advertising and marketing like:

At times, insurance may not agree to cover all damages, citing a lack of sufficient damage to cover the roof repair costs, saying the damage is anything but for hail, or that the hail damage is old and cannot be covered by the recent storm date. That’s what makes a roof insurance claim denied so confusing.

Stress levels can soar when a homeowner’s claim is denied. As of early 2022, the average cost to replace a 2,000 square foot roof is $12,000 to $15,000 but can more than double in price based on the roofing material, the roof pitch, accessibility, and actual size of the roof. For many homeowners, funding this cost yourself is simply not financially possible.

What can you do with an insurance denied roof claim? The good news is that the insurance companies do not have the last word. If your roof insurance claim is denied, you may go the route of insurance claim appraisal. Homeowners can elect this policy option whether the claim is wholly or partially denied, meaning that the covered amount is undervalued to cover all roof replacement costs.

The insurance claim experts at Metro City Roofing have you covered. We do not walk away from customers simply because the insurance company says no. We differ from other roofing companies as we advocate for our customers throughout the claims process until we successfully settle your hail damage roof claim.

Your claim denial is not the final word. Continue reading to learn more details about the insurance claims denial and appraisal process.

Appraisal is a popular term when buying a home and working to obtain a mortgage, where an inspector will determine the home’s fair market value to ensure sufficient equity to qualify for the loan. Yet Insurance claim appraisal is not a term with which many homeowners or policyholders are familiar, but it is included as standard policy language and your right.

So how does the insurance appraisal process work? The appraisal process begins by signing and submitting an Appraisal Demand Letter (ADL) to the insurance company. Once receiving the Appraisal Demand Letter, the insurance company has a finite timeline to review the request and select its appraiser under the insurance policy terms. This appraiser is to be independent – and not simply an extension of the insurance company’s previous response. Once the appraisers are selected, they must choose a neutral, third-party umpire in case both appraisers cannot reach an aligned resolution. The two appraisers and the umpire are known as the appraisal “panel.” From there, agreement by any two of the three appraisal panel members will finalize the extent of loss and set the financial coverage amounts.

The need for appraisal may be that the insurance company denied your claim entirely. Or it does not agree to pay for parts of the claim, like Contractor Overhead and Profit, which is an industry-standard term to fund hiring a single contractor to manage your entire claim when the claim includes multiple trades. An example of warranted Overhead and Profit would be when your claim consists of a new roof replacement, new gutters, skylights, solar, windows, siding, screens, or any combination.

Further, your home may be positioned with limited access for roof materials to be loaded directly onto your roof. There is no nearby driveway to allow discarded materials to be tossed from the roof. On some occasions, a home may have a driveway with pavers or heated pavers, and the roof supply distributor and the contractor cannot use the driveway at all. When this happens, the insured has the right to invoke the insurance appraisal process to cover all needed work scope at fair market value fairly.

The appraisal provision in your homeowners insurance policy allows the insured (the policyholder) to hire an independent to represent them. Both appraisers agree to meet, each armed with the previous positions, to inspect themselves and work towards resolution in the scope of damages and cost. The Amount of Loss is the total dollar amount needed to return the damaged property like your roof and any other damaged property back to its pre-storm or pre-event condition, either by repair or replacement.

It is important to note that the appraisal process is time-consuming. We do not recommend invoking this right until after your insurance carrier has clarified its unwillingness to further review and work towards a fair settlement.

At Metro City Roofing, we work with homeowners to demand appraisal less than 10% of the time. For half of our cases, we may simply be focused scope beyond the roof, best representing our clients on a case-by-case basis.

We see several insurance companies moving away from the industry-standard estimating software Xactimate to an alternate Symbility. Symbility has become attractive for insurance companies for paying less than fair market value.

Unfortunately, insurance adjusters may be directed to specific outcomes. Insurance adjusters may receive direction from their managers to affect results. In 2021, our company was involved with a State Farm denied roof claim where the insurance adjuster was on the roof for less than 60 seconds before advising that the damage to the roof shingles was not hail damage. When questioned, he said he had no idea what the damage was, only that it indeed was not hail. It was simply impossible to complete a thorough inspection in that amount of time. The adjuster simply never attempted to provide an unbiased assessment in less than one minute.

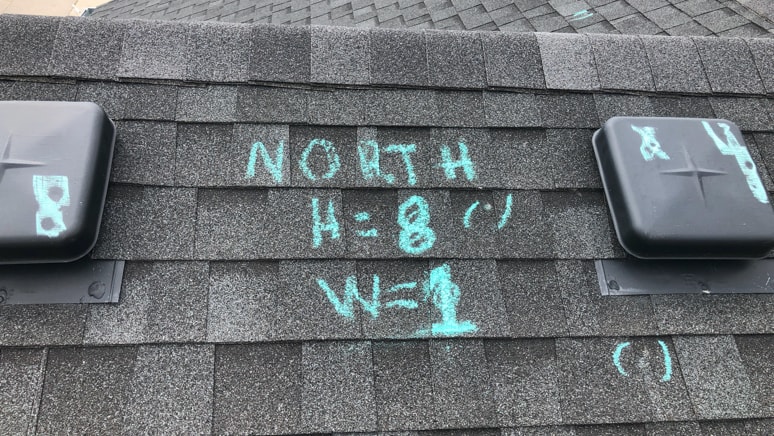

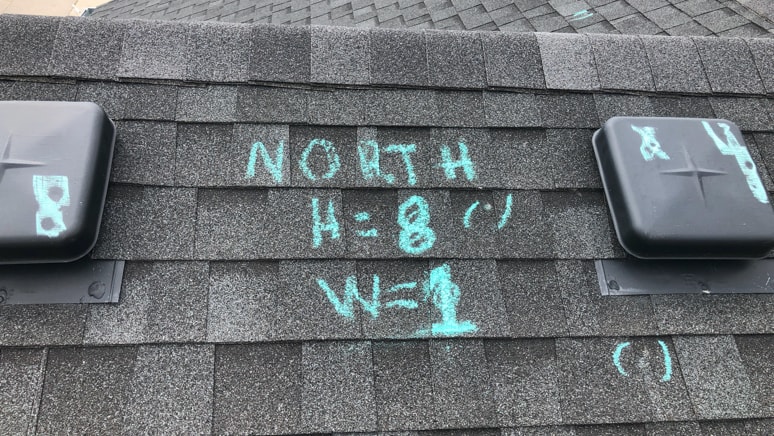

That adjuster then included 19 roof vents for hail damage, which opened the door for a reinspection. Still, the following State Farm adjuster denied the roof again but marked hail damage to one shingle and included hail damage to the gutters, downspouts, window screens, and garage doors. Since nearly half the neighborhood had their roofs replaced, including ten by our company Metro City Roofing, we recommended demanding an appraisal. The homeowner agreed, signed an Appraisal Demand Letter, and submitted it to State Farm. The two appraisers met and decided that the roof had extensive hail damage and was approved for the entire roof replacement. We needed some patience and trust in the process.

Similarly, in 2016, we had an Allstate denied roof claim where we had documented extensive hail damage on a roof and had already replaced three neighbors’ roofs on the same block. One of our company representatives met the insurance adjuster. Upon arrival, the adjuster stated no hail damage on that roof. Stunned, we asked if he had been on the roof, to which he replied no – but restated there was no hail damage on the roof. He eventually agreed to get onto the roof but quickly was off the roof within 45 seconds, marking no damage. He was clearly instructed to deny all claims.

Thus, the insurance claims process is not always straightforward. Once you file the insurance claim, there may be only one person involved from the insurance company, assuming the roof claim is approved. Or there may be several people involved in the example above.

After the insurance company’s inspection, the policyholder will receive a summary of damages and the decision. If the claim is approved, you will receive an initial estimate listing the overview of damages. If the claim is denied, the insurance company will have you believe there is nothing else you can do. Of course, insurers rarely have the final say for your insurance company denying a roof claim. There may be underlying reasons beyond damage to your specific roof that determine the outcome.

Homeowners contact us as a professional roofing contractor and share comments like, “Allstate denied my roof claim. Is there anything I can do?” There may be legitimate reasons that a roof claim was denied, like minimal or no hail damage or the homeowner filed the claim past the filing limit. That doesn’t mean a homeowner should simply accept the insurance adjuster’s position and move on. We offer free roof inspections and are happy to provide another opinion.

In some cases, the insurer’s decision is baseless or uninformed. The great news is that even if the insurers deny your roof insurance claim, all hope is not lost.

Having a trusted roofer with the knowledge and experience on what to do next and how to appeal a denied insurance claim is critical to getting your roof claim approved for complete roof replacement.

When an adjuster denies your roof insurance claim, it may be hard to comprehend. At Metro City Roofing, we are a professional roofing contractor where every sales and project team member is a licensed adjuster, completing the same industry-standard testing as the insurance company adjusters. It’s difficult for us to hear an adjuster inform a homeowner that the roof has damage. They do not know what caused it, but it is not hail. Adjusters defend this weak position by stating they don’t need to know what caused the roof damage, only that they know what didn’t cause the damage.

There may be additional reasons your roof insurance claim is denied. For example, you may not have owned the property at the date of loss for the hailstorm. The real estate market is hot these days, with some buyers waiving the right to a home inspection. When this happens, if the homeowner learns that roof damage exists, she cannot get their roof claim approved. It is a policy condition that the policyholder must own the home at the date of the storm. However, if you change insurance companies, you can still file a claim with your previous insurance company with a successful result.

Insurance companies must deny claims when a policyholder has a roof exclusion policy. At Metro City Roofing, we inspected a roof in Fort Collins, Colorado, with extensive hail damage and deterioration. The damage was so bad that the roof’s deck was visible in spots, which explained the more than five interior leaks. We recommended a hail claim and learned that the homeowner opted for an inexpensive policy and selected a roof exclusion. That meant the homeowner had to pay 100% of the roof replacement costs – and insurance had no responsibility.

There are times when the insurance company doesn’t technically deny the claim, but the homeowner receives no payment to cover damages. It might be that the roof damage was minimal, and the repair or replacement costs do not meet the homeowner’s insurance deductible. It is essential to know your insurance deductible for hail or wind claims and ensure that you have the financial means to cover your deductible in an extreme storm.

It’s also important to remember that a homeowner’s insurance policy covers natural disasters like hail or wind but will not cover basic home or roof maintenance. So, if the damage is old, outside the coverage period where a homeowner can file a claim, or if the damage is considered normal wear and tear, insurance will not cover the repairs or damage.

Insurance companies typically allow only one year to file a claim, so we strongly recommend having your roof inspected immediately following a storm and filing a claim timely if you learn that your roof has damage.

Below are the most common reasons for denying roof claims:

If your insurance company paid you for previous roof damage and you’ve not completed the work, your insurance company will deny your claim. However, if additional damages were not included in a previous claim, your insurance company will cover those. Unfortunately, if the insurance estimate previously included the roof, most additional damage will be minor – and unlikely enough to cover the insurance deductible.

Homeowners insurance policies set specific time limits that allow policyholders to file a hail or wind damage roof claim. The time limit is one year for most insurance companies, while State Farm allows two years. If one waits too long to file a claim, there is simply nothing an insurance company can do to approve your claim, regardless of damages. And home insurance for hail and wind is intended to cover a specific weather event within this timeframe. Thus, old damages are not covered by insurance but are considered maintenance issues.

PROOF POINT

In 2018, we had a Denver customer contact us concerned about hail damage to her roof. During our inspection, we validated her concerns and recommended filing a claim with her insurer USAA. One spring morning, one of our salespeople met with the adjuster, who advised that the homeowner had filed a claim in 2016, which already covered the house roof. We inspected the roof and documented new damage to the home’s garage and flat roof porch, not included in the previous claim.

The homeowner received proceeds to cover this further damage, less her deductible, but declined to do the work since she would have had to cover the previous amount paid with her earlier claim – and the cost of two deductibles.

For an insurance claim to cover a complete roof replacement, the assigned insurance adjuster must identify and document enough damages to the entire roof, and more than a partial repair would fix. Each insurance company sets its criterion for determining the required damages for roof replacement vs. roof repairs. But the insurance adjuster is the initial decision-maker to decide your claim’s fate.

It can be very frustrating to see many homes in your neighborhood getting new roofs. At the same time, your claim was denied or covered for partial damage, like paying to replace the front elevation and several exhaust vents but not the entire roof. In some cases, the adjuster simply doesn’t see any further damages, but he may be instructed to pay for roof repairs vs. a roof replacement in other cases. The good news for homeowners is that partial damage is one of the most likely denials to be overturned.

PROOF POINT

At Metro City Roofing, we had a State Farm claim in 2015 where an insurance adjuster agreed to cover 75% of the roof (e.g., front, right, rear) but not the last 25% that would have allowed the entire roof replacement covered by insurance. We disputed this adjuster’s position, and the insurance company sent out a different adjuster. This new adjuster agreed to cover everything.

Some asphalt shingle manufacturers have earned reputations for better quality than others. All manufacturers try to maintain quality control of their products, but some do better than others. Roofing materials, like asphalt shingles, are no different. Shingles with manufacturing defects will degrade earlier than their intended life expectancy. When an adjuster determines that your roof damage is not the result of hail but rather a manufacturing defect, they are not responsible for covering your replacement costs.

Further, all manufacturers have material warranties with the purchase of their products. The warranty coverage varies by manufacturer and actual warranty selected, such as choosing a more extended warranty. Some extended warranties cover materials only, some that coverage depreciates over time, while others cover materials and labor.

At Metro City Roofing, we install the best products from the industry’s top manufacturers. We will not install some brands due to their reputation, impacting our reputation as a leading Denver metro roofing contractor.

PROOF POINT

In 2019, a customer in Denver, Colorado, contacted us about hail damage to his roof following a recent hailstorm. One of our licensed roof inspectors confirmed damages and recommended filing an insurance claim.

The insurance adjuster denied the claim citing a manufacturing defect as the cause of roof damage. Based on the roof’s age, the manufacturer changed the length of its asphalt shingles in the early 2000s, which inhibited our ability to replace individual shingles without replacing the entire roof. We disputed the insurance inspection results, and the homeowner got a new roof.

Manufacturers have strict limits on what they will pay for repairs or replacements for defect issues. Unfortunately, the amount is often insufficient to complete all work without the homeowner paying additional costs.

PROOF POINT

In 2021, a customer in Colorado Springs contacted us to advise that someone knocked on his door and said he could get a new roof covered by a manufacturing defect. The homeowner didn’t trust the door-to-door salesperson and contacted his insurance agent, who recommended Metro City Roofing. We did see minimal shingle damage during our roof inspection, but nothing to justify replacing the entire roof. Further, since the roof had solar panels, the homeowner would have had to pay to detach and later reinstall it, putting him in a position to pay nearly $10,000 of his $20,000 roof replacement. He didn’t do the work.

Insurance companies establish policy language that dictates the time a policyholder can file a claim from a hailstorm or windstorm.

Insurance companies may request that the insured or selected roofing contractor provide evidence of damages with photos, code documentation, receipts, or additional supporting evidence. To err is human, and the insurance company may learn that some damage was overlooked and change their position or agree to a reinspection. When the insurance company does not budge, we recommend contacting your local agent directly (if one exists) and asking them to advocate on your behalf. Local agents want satisfied customers and will frequently help when there is evidence of damage.

We recommend that our clients ask for an expected timeline for review and decision. Insurance companies can intentionally avoid providing this critical information. Based on the outcome of your request for reinspection, all hope is not lost.

We recommend the following tips to avoid being in the situation where the insurance company to which you pay annual premiums denies your roof damage claim. Do your research, have the right insurance coverage, properly maintain your property, and file a claim timely if you must are the best methods to getting your claim approved vs. denied.

The following provides more detail about doing all you can to avoid getting your roof damage claim denied.

Regardless of advertising campaigns and marketing, not all insurance companies have the same reputation for approving claims with fair market value payments. We highly recommend researching which company has earned the best reputation for coverage payments when storm damage occurs. Speak with friends and neighbors, search reviews for a local insurance agent on Google or the Better Business Bureau to better understand customer satisfaction.

Some insurance companies like Allstate, Safeco, and Liberty Mutual have recently switched to different estimating software that pays an average of 30% less than fair market value. Homeowners with these carriers are turning to the appraisal process simply to get paid enough to hire a roofing contractor to complete the roof repair or replacement scope of damages.

Further, research the different types of coverage, like Replacement Cost Value vs. Actual Cash Value, roof exclusion policy, code coverage, and whether you prefer a lower deductible with a higher premium or the opposite.

Now that you’ve done some research, we recommend calling to speak with a live, experienced agent to discuss your objectives and coverage options. It’s best to have the agent create several options to suit your needs and budget.

Colorado Roofing Expert, Founder of Metro City Roofing

Jonathan loves the roofing industry as his company helps individual customers to navigate the insurance claim process and get them the new roof they need after a hailstorm. He has earned numerous roofing certifications and licenses, including the distinguished All Lines Adjuster License.